Temporal

This package provides a flexible & efficient time series class, TS, for the Julia programming language. While still early in development, the overarching goal is for the class to be able to slice & dice data with the rapid prototyping speed of R's xts and Python's pandas packages, while retaining the performance one expects from Julia.

Installation

Temporal can be easily installed using Julia's built-in package manager.

using Pkg

Pkg.add("Temporal")

using TemporalIntroduction

The TS Type

Member Variables

TS objects store three member variables to facilitate data manipulation and analysis.

values: anArrayof the values of the time series dataindex: aVectorwhose elements are either of typeDateorDateTimeindexing the values of the time seriesfields: aVectorwhose elements are of typeSymbolrepresenting the column names of the time series data

Constructors

The TS object type can be created in a number of ways. One thing to note is that when constructing the TS object, passing only the Array of values will automatically create the index and the fields members. When not passed explicitly, the index defaults to a series of dates that ends with today's date, and begins N-1 days before (where N is the number of rows of the values). The fields (or column names) are automatically set in a similar fashion as Excel when not given explicitly (A, B, C, ..., X, Y, Z, AA, AB, ...).

julia> using Temporal, Dates

julia> N, K = 100, 4;

julia> Random.seed!(1);

ERROR: UndefVarError: Random not defined

julia> values = rand(N, K);

julia> TS(values)

100x4 TS{Float64,Dates.Date}: 2019-10-15 to 2020-01-22

Index A B C D

2019-10-15 0.2177 0.5643 0.7495 0.6068

2019-10-16 0.2423 0.2202 0.5364 0.4645

2019-10-17 0.2919 0.3229 0.9707 0.8092

2019-10-18 0.2403 0.6756 0.9316 0.172

2019-10-19 0.9082 0.8792 0.2063 0.2342

2019-10-20 0.6194 0.4831 0.2652 0.5802

2019-10-21 0.6887 0.6364 0.449 0.1051

⋮

2020-01-15 0.6132 0.2045 0.1095 0.7481

2020-01-16 0.0341 0.8973 0.4979 0.9655

2020-01-17 0.6647 0.2151 0.6944 0.2312

2020-01-18 0.0892 0.7273 0.0243 0.2069

2020-01-19 0.8108 0.6423 0.197 0.1179

2020-01-20 0.1057 0.627 0.5414 0.5552

2020-01-21 0.5531 0.9182 0.8844 0.9071

2020-01-22 0.7044 0.9542 0.5507 0.9445

julia> index = today()-Day(N-1):Day(1):today();

julia> TS(values, index)

100x4 TS{Float64,Dates.Date}: 2019-10-15 to 2020-01-22

Index A B C D

2019-10-15 0.2177 0.5643 0.7495 0.6068

2019-10-16 0.2423 0.2202 0.5364 0.4645

2019-10-17 0.2919 0.3229 0.9707 0.8092

2019-10-18 0.2403 0.6756 0.9316 0.172

2019-10-19 0.9082 0.8792 0.2063 0.2342

2019-10-20 0.6194 0.4831 0.2652 0.5802

2019-10-21 0.6887 0.6364 0.449 0.1051

⋮

2020-01-15 0.6132 0.2045 0.1095 0.7481

2020-01-16 0.0341 0.8973 0.4979 0.9655

2020-01-17 0.6647 0.2151 0.6944 0.2312

2020-01-18 0.0892 0.7273 0.0243 0.2069

2020-01-19 0.8108 0.6423 0.197 0.1179

2020-01-20 0.1057 0.627 0.5414 0.5552

2020-01-21 0.5531 0.9182 0.8844 0.9071

2020-01-22 0.7044 0.9542 0.5507 0.9445

julia> fields = [:A, :B, :C, :D];

julia> X = TS(values, index, fields)

100x4 TS{Float64,Dates.Date}: 2019-10-15 to 2020-01-22

Index A B C D

2019-10-15 0.2177 0.5643 0.7495 0.6068

2019-10-16 0.2423 0.2202 0.5364 0.4645

2019-10-17 0.2919 0.3229 0.9707 0.8092

2019-10-18 0.2403 0.6756 0.9316 0.172

2019-10-19 0.9082 0.8792 0.2063 0.2342

2019-10-20 0.6194 0.4831 0.2652 0.5802

2019-10-21 0.6887 0.6364 0.449 0.1051

⋮

2020-01-15 0.6132 0.2045 0.1095 0.7481

2020-01-16 0.0341 0.8973 0.4979 0.9655

2020-01-17 0.6647 0.2151 0.6944 0.2312

2020-01-18 0.0892 0.7273 0.0243 0.2069

2020-01-19 0.8108 0.6423 0.197 0.1179

2020-01-20 0.1057 0.627 0.5414 0.5552

2020-01-21 0.5531 0.9182 0.8844 0.9071

2020-01-22 0.7044 0.9542 0.5507 0.9445Equivalently, one can construct a TS object using the standard rand construction approach.

julia> Random.seed!(1);

ERROR: UndefVarError: Random not defined

julia> Y = rand(TS, (N,K))

100x4 TS{Float64,Dates.Date}: 2019-10-15 to 2020-01-22

Index A B C D

2019-10-15 0.7602 0.0188 0.5162 0.0155

2019-10-16 0.8095 0.238 0.9634 0.8136

2019-10-17 0.4684 0.8535 0.3422 0.3003

2019-10-18 0.9588 0.5026 0.6863 0.2596

2019-10-19 0.9123 0.4947 0.771 0.0745

2019-10-20 0.3779 0.1386 0.7488 0.0147

2019-10-21 0.2779 0.7322 0.8518 0.8784

⋮

2020-01-15 0.8992 0.8452 0.1165 0.0461

2020-01-16 0.1477 0.1004 0.238 0.2677

2020-01-17 0.4336 0.2912 0.5884 0.4724

2020-01-18 0.3302 0.2351 0.6646 0.7083

2020-01-19 0.1032 0.3069 0.0261 0.243

2020-01-20 0.0414 0.4943 0.7607 0.5045

2020-01-21 0.8222 0.5318 0.6282 0.9256

2020-01-22 0.035 0.2935 0.6676 0.9736

julia> X == Y

falseOperations

The standard operations that apply to Array objects will generally also work for TS objects. (If there is an operation that does not have a method defined for the TS type that you feel is missing, please don't hesitate to submit an issue and we will get it added ASAP.)

julia> cumsum(X)

100x4 TS{Float64,Dates.Date}: 2019-10-15 to 2020-01-22

Index A B C D

2019-10-15 0.2177 0.5643 0.7495 0.6068

2019-10-16 0.46 0.7844 1.2859 1.0713

2019-10-17 0.7519 1.1073 2.2566 1.8805

2019-10-18 0.9922 1.7829 3.1882 2.0526

2019-10-19 1.9004 2.6621 3.3946 2.2868

2019-10-20 2.5198 3.1451 3.6598 2.867

2019-10-21 3.2085 3.7815 4.1088 2.9721

⋮

2020-01-15 42.6786 46.3207 41.0402 43.1286

2020-01-16 42.7128 47.218 41.5381 44.0941

2020-01-17 43.3774 47.4332 42.2325 44.3253

2020-01-18 43.4666 48.1604 42.2568 44.5321

2020-01-19 44.2774 48.8027 42.4538 44.65

2020-01-20 44.383 49.4297 42.9952 45.2052

2020-01-21 44.9361 50.348 43.8796 46.1123

2020-01-22 45.6406 51.3022 44.4302 47.0568

julia> cumprod(1 + diff(log(Y)))

ERROR: MethodError: no method matching log(::TS{Float64,Dates.Date})

Closest candidates are:

log(!Matched::Float16) at math.jl:1019

log(!Matched::Complex{Float16}) at math.jl:1020

log(!Matched::Float64) at special/log.jl:254

...

julia> X + Y

100x4 TS{Float64,Dates.Date}: 2019-10-15 to 2020-01-22

Index A B C D

2019-10-15 0.9779 0.5831 1.2657 0.6223

2019-10-16 1.0518 0.4582 1.4998 1.2781

2019-10-17 0.7603 1.1764 1.3129 1.1095

2019-10-18 1.1991 1.1782 1.6179 0.4316

2019-10-19 1.8206 1.3739 0.9773 0.3087

2019-10-20 0.9973 0.6217 1.014 0.5949

2019-10-21 0.9665 1.3686 1.3008 0.9835

⋮

2020-01-15 1.5124 1.0497 0.2259 0.7943

2020-01-16 0.1819 0.9977 0.736 1.2332

2020-01-17 1.0983 0.5063 1.2828 0.7036

2020-01-18 0.4193 0.9623 0.6889 0.9151

2020-01-19 0.914 0.9491 0.2231 0.3609

2020-01-20 0.1471 1.1213 1.3022 1.0597

2020-01-21 1.3752 1.45 1.5126 1.8327

2020-01-22 0.7394 1.2477 1.2183 1.9181

julia> abs.(sin.(X))

100x4 TS{Float64,Dates.Date}: 2019-10-15 to 2020-01-22

Index A B C D

2019-10-15 0.216 0.5348 0.6813 0.5703

2019-10-16 0.24 0.2184 0.5111 0.448

2019-10-17 0.2878 0.3173 0.8253 0.7238

2019-10-18 0.238 0.6254 0.8026 0.1712

2019-10-19 0.7884 0.7702 0.2049 0.2321

2019-10-20 0.5806 0.4645 0.2621 0.5482

2019-10-21 0.6355 0.5943 0.4341 0.1049

⋮

2020-01-15 0.5755 0.2031 0.1092 0.6803

2020-01-16 0.0341 0.7816 0.4776 0.8223

2020-01-17 0.6168 0.2135 0.6399 0.2291

2020-01-18 0.089 0.6648 0.0243 0.2054

2020-01-19 0.7248 0.599 0.1957 0.1176

2020-01-20 0.1055 0.5868 0.5154 0.5271

2020-01-21 0.5253 0.7945 0.7735 0.7877

2020-01-22 0.6476 0.8159 0.5232 0.8102Usage

Data Input/Output

There are currently several options for how to get time series data into the Julia environment as Temporal.TS objects.

- Data Vendor Downloads

- Local Flat Files (CSV, TSV, etc.)

Quandl Data Downloads

julia> corn = quandl("CHRIS/CME_C1", from="2010-06-09", thru=string(Dates.today()), freq='w') # weekly corn price history

503x8 TS{Float64,Dates.Date}: 2010-06-13 to 2020-01-26

Index Open High Low Last Change Settle Volume Previous Day Open Interest

2010-06-13 345.5 349.75 345.25 349.5 NaN 349.5 161773.0 353285.0

2010-06-20 357.0 364.0 356.5 360.75 NaN 360.75 101835.0 262392.0

2010-06-27 345.0 345.25 339.0 340.5 NaN 340.5 125609.0 159949.0

2010-07-04 362.5 365.75 361.25 364.0 NaN 364.0 17351.0 20723.0

2010-07-11 377.5 377.5 374.0 375.25 NaN 375.25 7471.0 5603.0

2010-07-18 391.0 395.5 387.75 394.75 NaN 394.75 87390.0 400595.0

2010-07-25 377.0 377.5 370.0 371.25 NaN 371.25 68229.0 401677.0

⋮

2019-12-08 364.75 368.75 364.75 366.5 1.0 366.5 960.0 2286.0

2019-12-15 373.75 374.5 366.25 366.25 0.75 366.25 88.0 165.0

2019-12-22 386.5 389.5 386.0 387.75 1.25 387.75 68692.0 754264.0

2019-12-29 388.0 391.0 388.0 390.0 1.5 390.0 73843.0 748797.0

2020-01-05 391.5 392.0 385.5 386.0 5.0 386.5 112048.0 740797.0

2020-01-12 383.25 386.75 376.5 385.75 2.5 385.75 206470.0 733377.0

2020-01-19 377.0 389.5 376.75 389.0 13.75 389.25 275953.0 745179.0

2020-01-26 389.0 389.25 384.25 387.5 1.75 387.5 168620.0 707498.0

julia> corn = dropnan(corn) # remove rows with any NaN

310x8 TS{Float64,Dates.Date}: 2014-02-23 to 2020-01-26

Index Open High Low Last Change Settle Volume Previous Day Open Interest

2014-02-23 455.5 456.5 450.25 452.2 2.6 453.0 145346.0 244376.0

2014-03-02 448.0 458.75 447.75 458.0 9.4 457.5 37182.0 38695.0

2014-03-09 485.25 495.0 478.0 481.0 4.6 481.0 7141.0 7124.0

2014-03-16 484.5 484.75 480.5 485.2 1.0 472.25 316.0 515.0

2014-03-23 478.5 481.0 476.0 477.4 0.4 479.0 87347.0 548999.0

2014-03-30 491.0 496.25 489.0 490.0 7.4 492.0 120358.0 530465.0

2014-04-06 498.0 502.0 492.5 502.0 1.5 501.5 104110.0 482614.0

⋮

2019-12-08 364.75 368.75 364.75 366.5 1.0 366.5 960.0 2286.0

2019-12-15 373.75 374.5 366.25 366.25 0.75 366.25 88.0 165.0

2019-12-22 386.5 389.5 386.0 387.75 1.25 387.75 68692.0 754264.0

2019-12-29 388.0 391.0 388.0 390.0 1.5 390.0 73843.0 748797.0

2020-01-05 391.5 392.0 385.5 386.0 5.0 386.5 112048.0 740797.0

2020-01-12 383.25 386.75 376.5 385.75 2.5 385.75 206470.0 733377.0

2020-01-19 377.0 389.5 376.75 389.0 13.75 389.25 275953.0 745179.0

2020-01-26 389.0 389.25 384.25 387.5 1.75 387.5 168620.0 707498.0Yahoo! Finance Downloads

julia> snapchat_prices = yahoo("SNAP", from="2017-03-03") # historical prices for Snapchat since its IPO date

726x6 TS{Float64,Dates.Date}: 2017-03-03 to 2020-01-21

Index Open High Low Close AdjClose Volume

2017-03-03 26.39 29.44 26.06 27.09 27.09 1.481664e8

2017-03-06 28.17 28.25 23.77 23.77 23.77 7.2903e7

2017-03-07 22.21 22.5 20.64 21.44 21.44 7.18578e7

2017-03-08 22.03 23.43 21.31 22.81 22.81 4.98191e7

2017-03-09 23.17 23.68 22.51 22.71 22.71 2.58032e7

2017-03-10 23.36 23.4 22.0 22.07 22.07 1.83376e7

2017-03-13 22.05 22.15 20.96 21.09 21.09 2.06059e7

⋮

2020-01-09 17.29 17.93 17.04 17.36 17.36 6.27142e7

2020-01-10 17.66 17.73 17.28 17.41 17.41 2.56217e7

2020-01-13 17.48 18.0 17.3 18.0 18.0 2.23939e7

2020-01-14 17.99 18.09 17.665 17.99 17.99 2.53901e7

2020-01-15 18.0 18.52 17.97 18.19 18.19 2.33813e7

2020-01-16 18.02 18.41 17.777 18.25 18.25 2.70507e7

2020-01-17 19.1 19.29 18.76 19.11 19.11 4.63173e7

2020-01-21 19.02 19.25 18.77 19.0 19.0 2.47756e7

julia> exxon_dividends = yahoo("XOM", event="div", from="2000-01-01", thru="2009-12-31") # all dividend payments Exxon disbursed during the 2000's

42x1 TS{Float64,Dates.Date}: 2000-02-09 to 2009-11-09

Index Dividends

2000-02-09 0.44

2000-05-11 0.44

2000-08-10 0.44

2000-11-09 0.44

2001-02-07 0.44

2001-02-08 0.44

2001-05-10 0.44

⋮

2008-02-07 0.35

2008-05-09 0.4

2008-08-11 0.4

2008-11-07 0.4

2009-02-06 0.4

2009-05-11 0.42

2009-08-11 0.42

2009-11-09 0.42Flat File I/O

julia> filepath = "tmp.csv"

"tmp.csv"

julia> tswrite(corn, filepath)

julia> tsread(filepath) == corn

trueSubsetting/Indexing

Easily one of the more important parts of handling time series data is the ability to retrieve from that time series specific portions of the data that you want. To this end, TS objects provide a fairly flexible indexing interface to make it easier to slice & dice data in the ways commonly desired, while maintaining an emphasis on speed and performance wherever possible.

As an example use case, let us analyze the price history of front-month crude oil futures.

julia> crude = quandl("CHRIS/CME_CL1") # download crude oil prices from Quandl

9250x8 TS{Float64,Dates.Date}: 1983-03-30 to 2020-01-21

Index Open High Low Last Change Settle Volume Previous Day Open Interest

1983-03-30 29.01 29.56 29.01 29.4 NaN 29.4 949.0 470.0

1983-03-31 29.4 29.6 29.25 29.29 NaN 29.29 521.0 523.0

1983-04-04 29.3 29.7 29.29 29.44 NaN 29.44 156.0 583.0

1983-04-05 29.5 29.8 29.5 29.71 NaN 29.71 175.0 623.0

1983-04-06 29.9 29.92 29.65 29.9 NaN 29.9 392.0 640.0

1983-04-07 29.9 30.2 29.86 30.17 NaN 30.17 817.0 795.0

1983-04-08 30.65 30.65 30.25 30.38 NaN 30.38 365.0 651.0

⋮

2020-01-09 59.99 60.31 58.66 59.59 0.05 59.56 738556.0 321112.0

2020-01-10 59.61 59.78 58.85 59.12 0.52 59.04 579590.0 281957.0

2020-01-13 59.04 59.27 57.91 58.09 0.96 58.08 572099.0 235115.0

2020-01-14 58.03 58.72 57.72 58.14 0.15 58.23 494837.0 185715.0

2020-01-15 58.2 58.36 57.36 58.1 0.42 57.81 426110.0 136771.0

2020-01-16 58.1 58.87 57.56 58.59 0.71 58.52 178898.0 96523.0

2020-01-17 58.59 58.98 58.27 58.81 0.02 58.54 118984.0 73735.0

2020-01-21 59.17 59.73 57.68 58.25 0.2 58.34 36251.0 31495.0

julia> crude = dropnan(crude) # remove the missing values from the downloaded data

1488x8 TS{Float64,Dates.Date}: 2014-02-18 to 2020-01-21

Index Open High Low Last Change Settle Volume Previous Day Open Interest

2014-02-18 100.32 103.25 100.23 102.43 2.13 102.43 168003.0 66485.0

2014-02-19 103.14 103.8 102.4 103.31 0.88 103.31 85672.0 29350.0

2014-02-20 103.41 103.5 102.75 103.05 0.39 102.92 36274.0 29350.0

2014-02-21 102.87 102.92 101.69 102.2 0.55 102.2 163793.0 320747.0

2014-02-24 102.29 103.45 101.97 102.82 0.62 102.82 169414.0 324685.0

2014-02-25 102.8 102.84 101.02 101.83 0.99 101.83 179081.0 320864.0

2014-02-26 102.04 102.9 101.58 102.55 0.76 102.59 187756.0 318599.0

⋮

2020-01-09 59.99 60.31 58.66 59.59 0.05 59.56 738556.0 321112.0

2020-01-10 59.61 59.78 58.85 59.12 0.52 59.04 579590.0 281957.0

2020-01-13 59.04 59.27 57.91 58.09 0.96 58.08 572099.0 235115.0

2020-01-14 58.03 58.72 57.72 58.14 0.15 58.23 494837.0 185715.0

2020-01-15 58.2 58.36 57.36 58.1 0.42 57.81 426110.0 136771.0

2020-01-16 58.1 58.87 57.56 58.59 0.71 58.52 178898.0 96523.0

2020-01-17 58.59 58.98 58.27 58.81 0.02 58.54 118984.0 73735.0

2020-01-21 59.17 59.73 57.68 58.25 0.2 58.34 36251.0 31495.0Column Indexing

The fields member of the Temporal.TS object (wherein the column names are stored) are represented using Julia's builtin Symbol datatype.

julia> crude[:Settle]

1488x1 TS{Float64,Dates.Date}: 2014-02-18 to 2020-01-21

Index Settle

2014-02-18 102.43

2014-02-19 103.31

2014-02-20 102.92

2014-02-21 102.2

2014-02-24 102.82

2014-02-25 101.83

2014-02-26 102.59

⋮

2020-01-09 59.56

2020-01-10 59.04

2020-01-13 58.08

2020-01-14 58.23

2020-01-15 57.81

2020-01-16 58.52

2020-01-17 58.54

2020-01-21 58.34

julia> crude[[:Settle,:Volume]]

1488x2 TS{Float64,Dates.Date}: 2014-02-18 to 2020-01-21

Index Settle Volume

2014-02-18 102.43 168003.0

2014-02-19 103.31 85672.0

2014-02-20 102.92 36274.0

2014-02-21 102.2 163793.0

2014-02-24 102.82 169414.0

2014-02-25 101.83 179081.0

2014-02-26 102.59 187756.0

⋮

2020-01-09 59.56 738556.0

2020-01-10 59.04 579590.0

2020-01-13 58.08 572099.0

2020-01-14 58.23 494837.0

2020-01-15 57.81 426110.0

2020-01-16 58.52 178898.0

2020-01-17 58.54 118984.0

2020-01-21 58.34 36251.0

julia> crude[1:100, :Volume]

100x1 TS{Float64,Dates.Date}: 2014-02-18 to 2014-07-10

Index Volume

2014-02-18 168003.0

2014-02-19 85672.0

2014-02-20 36274.0

2014-02-21 163793.0

2014-02-24 169414.0

2014-02-25 179081.0

2014-02-26 187756.0

⋮

2014-06-30 229049.0

2014-07-01 231393.0

2014-07-02 249258.0

2014-07-03 185064.0

2014-07-07 170076.0

2014-07-08 249378.0

2014-07-09 265417.0

2014-07-10 253268.0A series of financial extractor convenience functions are also made available for commonly used tasks involving the selection of specific fields from historical financial market data.

julia> vo(crude) # volume

1488x1 TS{Float64,Dates.Date}: 2014-02-18 to 2020-01-21

Index Volume

2014-02-18 168003.0

2014-02-19 85672.0

2014-02-20 36274.0

2014-02-21 163793.0

2014-02-24 169414.0

2014-02-25 179081.0

2014-02-26 187756.0

⋮

2020-01-09 738556.0

2020-01-10 579590.0

2020-01-13 572099.0

2020-01-14 494837.0

2020-01-15 426110.0

2020-01-16 178898.0

2020-01-17 118984.0

2020-01-21 36251.0

julia> op(crude) # open

1488x1 TS{Float64,Dates.Date}: 2014-02-18 to 2020-01-21

Index Open

2014-02-18 100.32

2014-02-19 103.14

2014-02-20 103.41

2014-02-21 102.87

2014-02-24 102.29

2014-02-25 102.8

2014-02-26 102.04

⋮

2020-01-09 59.99

2020-01-10 59.61

2020-01-13 59.04

2020-01-14 58.03

2020-01-15 58.2

2020-01-16 58.1

2020-01-17 58.59

2020-01-21 59.17

julia> hi(crude) # high

1488x1 TS{Float64,Dates.Date}: 2014-02-18 to 2020-01-21

Index High

2014-02-18 103.25

2014-02-19 103.8

2014-02-20 103.5

2014-02-21 102.92

2014-02-24 103.45

2014-02-25 102.84

2014-02-26 102.9

⋮

2020-01-09 60.31

2020-01-10 59.78

2020-01-13 59.27

2020-01-14 58.72

2020-01-15 58.36

2020-01-16 58.87

2020-01-17 58.98

2020-01-21 59.73

julia> lo(crude) # low

1488x1 TS{Float64,Dates.Date}: 2014-02-18 to 2020-01-21

Index Low

2014-02-18 100.23

2014-02-19 102.4

2014-02-20 102.75

2014-02-21 101.69

2014-02-24 101.97

2014-02-25 101.02

2014-02-26 101.58

⋮

2020-01-09 58.66

2020-01-10 58.85

2020-01-13 57.91

2020-01-14 57.72

2020-01-15 57.36

2020-01-16 57.56

2020-01-17 58.27

2020-01-21 57.68

julia> cl(crude) # close (note: will take fields named :Close, :AdjClose, :Settle, and :Last)

1488x1 TS{Float64,Dates.Date}: 2014-02-18 to 2020-01-21

Index Settle

2014-02-18 102.43

2014-02-19 103.31

2014-02-20 102.92

2014-02-21 102.2

2014-02-24 102.82

2014-02-25 101.83

2014-02-26 102.59

⋮

2020-01-09 59.56

2020-01-10 59.04

2020-01-13 58.08

2020-01-14 58.23

2020-01-15 57.81

2020-01-16 58.52

2020-01-17 58.54

2020-01-21 58.34ohlc(crude)

ohlcv(crude)

hl(crude)

hlc(crude)

hl2(crude) # average of high and low

hlc3(crude) # average of high, low, and close

ohlc4(crude) # average of open, high, low, and close1488x1 TS{Float64,Dates.Date}: 2014-02-18 to 2020-01-21

Index A

2014-02-18 101.5575

2014-02-19 103.1625

2014-02-20 103.145

2014-02-21 102.42

2014-02-24 102.6325

2014-02-25 102.1225

2014-02-26 102.2775

⋮

2020-01-09 59.63

2020-01-10 59.32

2020-01-13 58.575

2020-01-14 58.175

2020-01-15 57.9325

2020-01-16 58.2625

2020-01-17 58.595

2020-01-21 58.73

Row Indexing

Rows of TS objects can be indexed in much the same way as Julia's standard Array objects. Since time is the key differentiating characteristic of a time series dataset, however, indexing only one dimension with an integer (or array of integers) defaults to indexing along the time (row) dimension.

julia> crude[1] # get the first row

1x8 TS{Float64,Dates.Date}: 2014-02-18 to 2014-02-18

Index Open High Low Last Change Settle Volume Previous Day Open Interest

2014-02-18 100.32 103.25 100.23 102.43 2.13 102.43 168003.0 66485.0

julia> crude[end,:] # get the last row

1x8 TS{Float64,Dates.Date}: 2020-01-21 to 2020-01-21

Index Open High Low Last Change Settle Volume Previous Day Open Interest

2020-01-21 59.17 59.73 57.68 58.25 0.2 58.34 36251.0 31495.0

julia> crude[end-100:end, 1:4]

101x4 TS{Float64,Dates.Date}: 2019-08-26 to 2020-01-21

Index Open High Low Last

2019-08-26 53.25 55.26 52.96 53.8

2019-08-27 53.76 55.72 53.69 55.69

2019-08-28 55.71 56.75 55.34 55.9

2019-08-29 55.88 56.89 55.43 56.61

2019-08-30 56.63 56.72 54.55 55.16

2019-09-03 55.0 55.24 52.84 53.93

2019-09-04 53.92 56.58 53.84 55.98

⋮

2020-01-09 59.99 60.31 58.66 59.59

2020-01-10 59.61 59.78 58.85 59.12

2020-01-13 59.04 59.27 57.91 58.09

2020-01-14 58.03 58.72 57.72 58.14

2020-01-15 58.2 58.36 57.36 58.1

2020-01-16 58.1 58.87 57.56 58.59

2020-01-17 58.59 58.98 58.27 58.81

2020-01-21 59.17 59.73 57.68 58.25Additionally, rows can be selected/indexed using Date or DateTime objects (whichever type corresponds to the element type of the object's index member).

julia> final_date = crude.index[end]

2020-01-21

julia> crude[final_date]

1x8 TS{Float64,Dates.Date}: 2020-01-21 to 2020-01-21

Index Open High Low Last Change Settle Volume Previous Day Open Interest

2020-01-21 59.17 59.73 57.68 58.25 0.2 58.34 36251.0 31495.0

julia> crude[collect(today()-Year(1):Day(1):today())]

251x8 TS{Float64,Dates.Date}: 2019-01-22 to 2020-01-21

Index Open High Low Last Change Settle Volume Previous Day Open Interest

2019-01-22 53.73 54.24 51.8 52.77 1.23 52.57 39659.0 25682.0

2019-01-23 52.95 53.64 51.86 52.4 0.39 52.62 698010.0 499043.0

2019-01-24 52.45 53.47 52.07 53.18 0.51 53.13 708068.0 496877.0

2019-01-25 53.17 53.94 52.91 53.55 0.56 53.69 587559.0 481966.0

2019-01-28 53.56 53.64 51.33 52.09 1.7 51.99 645719.0 471888.0

2019-01-29 52.12 53.93 51.84 53.24 1.32 53.31 658505.0 469447.0

2019-01-30 53.24 54.93 53.09 54.22 0.92 54.23 720416.0 464251.0

⋮

2020-01-09 59.99 60.31 58.66 59.59 0.05 59.56 738556.0 321112.0

2020-01-10 59.61 59.78 58.85 59.12 0.52 59.04 579590.0 281957.0

2020-01-13 59.04 59.27 57.91 58.09 0.96 58.08 572099.0 235115.0

2020-01-14 58.03 58.72 57.72 58.14 0.15 58.23 494837.0 185715.0

2020-01-15 58.2 58.36 57.36 58.1 0.42 57.81 426110.0 136771.0

2020-01-16 58.1 58.87 57.56 58.59 0.71 58.52 178898.0 96523.0

2020-01-17 58.59 58.98 58.27 58.81 0.02 58.54 118984.0 73735.0

2020-01-21 59.17 59.73 57.68 58.25 0.2 58.34 36251.0 31495.0Finally, Temporal provides a querying interface that allows one to use a standardized string format structure to specify ranges of dates. Inspired by R's xts package, one of the most useful utilities for prototyping in the REPL is the ease with which one can subset out dates simply by passing easily readable character strings. Temporal implements this same logic for TS objects.

On a tangential note, it's interesting to observe that while this indexing logic is implemented in low-level C code in other packages, this logic has been implemented in pure julia, making it far easier to read, interpret, understand, debug, and/or adapt to one's own purposes.

julia> crude["2016"] # retrieve all rows from the year 2016

252x8 TS{Float64,Dates.Date}: 2016-01-04 to 2016-12-30

Index Open High Low Last Change Settle Volume Previous Day Open Interest

2016-01-04 37.6 38.39 36.33 36.88 0.28 36.76 426831.0 437108.0

2016-01-05 36.9 37.1 35.74 36.14 0.79 35.97 408389.0 437506.0

2016-01-06 36.18 36.39 33.77 34.06 2.0 33.97 528347.0 436383.0

2016-01-07 34.09 34.26 32.1 33.26 0.7 33.27 590277.0 431502.0

2016-01-08 33.3 34.34 32.64 32.88 0.11 33.16 567056.0 404315.0

2016-01-11 32.94 33.2 30.88 31.13 1.75 31.41 619080.0 337703.0

2016-01-12 30.44 32.21 29.93 30.58 0.97 30.44 620051.0 283331.0

⋮

2016-12-20 52.11 52.7 51.84 52.22 0.11 52.23 17494.0 20967.0

2016-12-21 53.56 53.79 52.32 52.51 0.81 52.49 466692.0 479955.0

2016-12-22 52.52 53.19 52.08 52.65 0.46 52.95 390212.0 471832.0

2016-12-23 52.68 53.28 52.26 53.25 0.07 53.02 278830.0 472794.0

2016-12-27 53.29 54.1 53.03 53.89 0.88 53.9 273372.0 458071.0

2016-12-28 53.93 54.37 53.56 53.66 0.16 54.06 320087.0 459982.0

2016-12-29 53.66 54.21 53.46 53.85 0.29 53.77 356339.0 458989.0

2016-12-30 53.87 54.09 53.41 53.89 0.05 53.72 266762.0 457983.0

julia> crude["2015", 6] # retrive the sixth column from 2015

252x1 TS{Float64,Dates.Date}: 2015-01-02 to 2015-12-31

Index Settle

2015-01-02 52.69

2015-01-05 50.04

2015-01-06 47.93

2015-01-07 48.65

2015-01-08 48.79

2015-01-09 48.36

2015-01-12 46.07

⋮

2015-12-21 34.74

2015-12-22 36.14

2015-12-23 37.5

2015-12-24 38.1

2015-12-28 36.81

2015-12-29 37.87

2015-12-30 36.6

2015-12-31 37.04

julia> crude["/2017", 1:4] # retrieve first four columns for all rows through 2017

974x4 TS{Float64,Dates.Date}: 2014-02-18 to 2017-12-29

Index Open High Low Last

2014-02-18 100.32 103.25 100.23 102.43

2014-02-19 103.14 103.8 102.4 103.31

2014-02-20 103.41 103.5 102.75 103.05

2014-02-21 102.87 102.92 101.69 102.2

2014-02-24 102.29 103.45 101.97 102.82

2014-02-25 102.8 102.84 101.02 101.83

2014-02-26 102.04 102.9 101.58 102.55

⋮

2017-12-19 57.3 57.64 57.16 57.49

2017-12-20 57.66 58.12 57.44 58.03

2017-12-21 58.02 58.38 57.63 58.23

2017-12-22 58.21 58.5 57.87 58.36

2017-12-26 58.4 60.01 58.32 59.8

2017-12-27 59.79 59.93 59.33 59.59

2017-12-28 59.53 59.94 59.44 59.89

2017-12-29 59.91 60.51 59.82 60.1

julia> crude["2015/", end-2:end] # retrieve last three columns for the year 2015 and on

1267x3 TS{Float64,Dates.Date}: 2015-01-02 to 2020-01-21

Index Settle Volume Previous Day Open Interest

2015-01-02 52.69 284836.0 306406.0

2015-01-05 50.04 392285.0 303470.0

2015-01-06 47.93 478105.0 294918.0

2015-01-07 48.65 486387.0 279774.0

2015-01-08 48.79 397064.0 260411.0

2015-01-09 48.36 460540.0 232826.0

2015-01-12 46.07 424561.0 201262.0

⋮

2020-01-09 59.56 738556.0 321112.0

2020-01-10 59.04 579590.0 281957.0

2020-01-13 58.08 572099.0 235115.0

2020-01-14 58.23 494837.0 185715.0

2020-01-15 57.81 426110.0 136771.0

2020-01-16 58.52 178898.0 96523.0

2020-01-17 58.54 118984.0 73735.0

2020-01-21 58.34 36251.0 31495.0

julia> crude["2014/2015", :Settle] # retrieve settle prices for the years 2014 and 2015

473x1 TS{Float64,Dates.Date}: 2014-02-18 to 2015-12-31

Index Settle

2014-02-18 102.43

2014-02-19 103.31

2014-02-20 102.92

2014-02-21 102.2

2014-02-24 102.82

2014-02-25 101.83

2014-02-26 102.59

⋮

2015-12-21 34.74

2015-12-22 36.14

2015-12-23 37.5

2015-12-24 38.1

2015-12-28 36.81

2015-12-29 37.87

2015-12-30 36.6

2015-12-31 37.04Combining/Joining

julia> gasoline = quandl("CHRIS/CME_RB1")

3591x8 TS{Float64,Dates.Date}: 2005-10-03 to 2020-01-21

Index Open High Low Last Change Settle Volume Previous Day Open Interest

2005-10-03 1.995 2.0 1.94 1.9488 NaN 1.9488 2774.0 14940.0

2005-10-04 1.91 1.9203 1.87 1.9203 NaN 1.9203 2533.0 15287.0

2005-10-05 1.928 1.93 1.832 1.8361 NaN 1.8361 3474.0 15297.0

2005-10-06 1.795 1.795 1.76 1.7867 NaN 1.7867 4675.0 15554.0

2005-10-07 1.79 1.8076 1.77 1.8076 NaN 1.8076 6554.0 15634.0

2005-10-10 1.78 1.7975 1.77 1.7971 NaN 1.7971 4434.0 15960.0

2005-10-11 1.8225 1.838 1.805 1.838 NaN 1.838 5185.0 17434.0

⋮

2020-01-09 1.6547 1.6655 1.6302 1.6571 0.0039 1.6527 64516.0 124051.0

2020-01-10 1.6579 1.6786 1.6508 1.6596 0.0069 1.6596 67041.0 115888.0

2020-01-13 1.6668 1.6668 1.6383 1.661 0.0023 1.6573 70476.0 113512.0

2020-01-14 1.6644 1.6851 1.6502 1.6586 0.0029 1.6544 78431.0 105037.0

2020-01-15 1.6605 1.6617 1.6262 1.6494 0.0176 1.6368 70047.0 96016.0

2020-01-16 1.6499 1.6613 1.6344 1.6595 0.018 1.6548 55726.0 87878.0

2020-01-17 1.6644 1.6666 1.6329 1.6473 0.0142 1.6406 57664.0 79592.0

2020-01-21 1.6524 1.6711 1.6123 1.6372 0.0041 1.6365 43028.0 74190.0

julia> gasoline_settles = cl(gasoline)

3591x1 TS{Float64,Dates.Date}: 2005-10-03 to 2020-01-21

Index Settle

2005-10-03 1.9488

2005-10-04 1.9203

2005-10-05 1.8361

2005-10-06 1.7867

2005-10-07 1.8076

2005-10-10 1.7971

2005-10-11 1.838

⋮

2020-01-09 1.6527

2020-01-10 1.6596

2020-01-13 1.6573

2020-01-14 1.6544

2020-01-15 1.6368

2020-01-16 1.6548

2020-01-17 1.6406

2020-01-21 1.6365

julia> gasoline_settles.fields = [:Gasoline]

1-element Array{Symbol,1}:

:Gasoline

julia> crude_settles = cl(crude)

1488x1 TS{Float64,Dates.Date}: 2014-02-18 to 2020-01-21

Index Settle

2014-02-18 102.43

2014-02-19 103.31

2014-02-20 102.92

2014-02-21 102.2

2014-02-24 102.82

2014-02-25 101.83

2014-02-26 102.59

⋮

2020-01-09 59.56

2020-01-10 59.04

2020-01-13 58.08

2020-01-14 58.23

2020-01-15 57.81

2020-01-16 58.52

2020-01-17 58.54

2020-01-21 58.34

julia> crude_settles.fields[1] = :Crude;

julia> # full outer join

A = ojoin(crude_settles, gasoline_settles)

3591x2 TS{Float64,Dates.Date}: 2005-10-03 to 2020-01-21

Index Crude Gasoline

2005-10-03 NaN 1.9488

2005-10-04 NaN 1.9203

2005-10-05 NaN 1.8361

2005-10-06 NaN 1.7867

2005-10-07 NaN 1.8076

2005-10-10 NaN 1.7971

2005-10-11 NaN 1.838

⋮

2020-01-09 59.56 1.6527

2020-01-10 59.04 1.6596

2020-01-13 58.08 1.6573

2020-01-14 58.23 1.6544

2020-01-15 57.81 1.6368

2020-01-16 58.52 1.6548

2020-01-17 58.54 1.6406

2020-01-21 58.34 1.6365

julia> # hcat -- same as full outer join

A = [crude_settles gasoline_settles]

3591x2 TS{Float64,Dates.Date}: 2005-10-03 to 2020-01-21

Index Crude Gasoline

2005-10-03 NaN 1.9488

2005-10-04 NaN 1.9203

2005-10-05 NaN 1.8361

2005-10-06 NaN 1.7867

2005-10-07 NaN 1.8076

2005-10-10 NaN 1.7971

2005-10-11 NaN 1.838

⋮

2020-01-09 59.56 1.6527

2020-01-10 59.04 1.6596

2020-01-13 58.08 1.6573

2020-01-14 58.23 1.6544

2020-01-15 57.81 1.6368

2020-01-16 58.52 1.6548

2020-01-17 58.54 1.6406

2020-01-21 58.34 1.6365# can join to arrays of same size

A = [A randn(size(A,1))]3591x3 TS{Float64,Dates.Date}: 2005-10-03 to 2020-01-21

Index Crude Gasoline A

2005-10-03 NaN 1.9488 0.5376

2005-10-04 NaN 1.9203 2.6784

2005-10-05 NaN 1.8361 0.1123

2005-10-06 NaN 1.7867 -0.7511

2005-10-07 NaN 1.8076 1.1034

2005-10-10 NaN 1.7971 -0.3219

2005-10-11 NaN 1.838 0.8071

⋮

2020-01-09 59.56 1.6527 -0.0969

2020-01-10 59.04 1.6596 1.1216

2020-01-13 58.08 1.6573 -1.6006

2020-01-14 58.23 1.6544 0.0053

2020-01-15 57.81 1.6368 -0.4695

2020-01-16 58.52 1.6548 0.1131

2020-01-17 58.54 1.6406 0.0599

2020-01-21 58.34 1.6365 0.3097

# can join to single numbers as well

A = [A 0]3591x4 TS{Float64,Dates.Date}: 2005-10-03 to 2020-01-21

Index Crude Gasoline A A

2005-10-03 NaN 1.9488 0.5376 0.0

2005-10-04 NaN 1.9203 2.6784 0.0

2005-10-05 NaN 1.8361 0.1123 0.0

2005-10-06 NaN 1.7867 -0.7511 0.0

2005-10-07 NaN 1.8076 1.1034 0.0

2005-10-10 NaN 1.7971 -0.3219 0.0

2005-10-11 NaN 1.838 0.8071 0.0

⋮

2020-01-09 59.56 1.6527 -0.0969 0.0

2020-01-10 59.04 1.6596 1.1216 0.0

2020-01-13 58.08 1.6573 -1.6006 0.0

2020-01-14 58.23 1.6544 0.0053 0.0

2020-01-15 57.81 1.6368 -0.4695 0.0

2020-01-16 58.52 1.6548 0.1131 0.0

2020-01-17 58.54 1.6406 0.0599 0.0

2020-01-21 58.34 1.6365 0.3097 0.0

# inner join -- keep points in time where both objects have observations

ijoin(crude_settles, gasoline_settles)1488x2 TS{Float64,Dates.Date}: 2014-02-18 to 2020-01-21

Index Crude Gasoline

2014-02-18 102.43 2.8323

2014-02-19 103.31 2.8247

2014-02-20 102.92 2.8466

2014-02-21 102.2 2.8333

2014-02-24 102.82 2.8336

2014-02-25 101.83 2.7981

2014-02-26 102.59 2.7992

⋮

2020-01-09 59.56 1.6527

2020-01-10 59.04 1.6596

2020-01-13 58.08 1.6573

2020-01-14 58.23 1.6544

2020-01-15 57.81 1.6368

2020-01-16 58.52 1.6548

2020-01-17 58.54 1.6406

2020-01-21 58.34 1.6365

# left join

ljoin(crude_settles, gasoline_settles)1488x2 TS{Float64,Dates.Date}: 2014-02-18 to 2020-01-21

Index Crude Gasoline

2014-02-18 102.43 2.8323

2014-02-19 103.31 2.8247

2014-02-20 102.92 2.8466

2014-02-21 102.2 2.8333

2014-02-24 102.82 2.8336

2014-02-25 101.83 2.7981

2014-02-26 102.59 2.7992

⋮

2020-01-09 59.56 1.6527

2020-01-10 59.04 1.6596

2020-01-13 58.08 1.6573

2020-01-14 58.23 1.6544

2020-01-15 57.81 1.6368

2020-01-16 58.52 1.6548

2020-01-17 58.54 1.6406

2020-01-21 58.34 1.6365

# right join

rjoin(crude_settles, gasoline_settles)3591x2 TS{Float64,Dates.Date}: 2005-10-03 to 2020-01-21

Index Crude Gasoline

2005-10-03 NaN 1.9488

2005-10-04 NaN 1.9203

2005-10-05 NaN 1.8361

2005-10-06 NaN 1.7867

2005-10-07 NaN 1.8076

2005-10-10 NaN 1.7971

2005-10-11 NaN 1.838

⋮

2020-01-09 59.56 1.6527

2020-01-10 59.04 1.6596

2020-01-13 58.08 1.6573

2020-01-14 58.23 1.6544

2020-01-15 57.81 1.6368

2020-01-16 58.52 1.6548

2020-01-17 58.54 1.6406

2020-01-21 58.34 1.6365

# vertical concatenation also implemented!

fracker_era = [crude["/2013"]; crude["2016/"]]1015x8 TS{Float64,Dates.Date}: 2016-01-04 to 2020-01-21

Index Open High Low Last Change Settle Volume Previous Day Open Interest

2016-01-04 37.6 38.39 36.33 36.88 0.28 36.76 426831.0 437108.0

2016-01-05 36.9 37.1 35.74 36.14 0.79 35.97 408389.0 437506.0

2016-01-06 36.18 36.39 33.77 34.06 2.0 33.97 528347.0 436383.0

2016-01-07 34.09 34.26 32.1 33.26 0.7 33.27 590277.0 431502.0

2016-01-08 33.3 34.34 32.64 32.88 0.11 33.16 567056.0 404315.0

2016-01-11 32.94 33.2 30.88 31.13 1.75 31.41 619080.0 337703.0

2016-01-12 30.44 32.21 29.93 30.58 0.97 30.44 620051.0 283331.0

⋮

2020-01-09 59.99 60.31 58.66 59.59 0.05 59.56 738556.0 321112.0

2020-01-10 59.61 59.78 58.85 59.12 0.52 59.04 579590.0 281957.0

2020-01-13 59.04 59.27 57.91 58.09 0.96 58.08 572099.0 235115.0

2020-01-14 58.03 58.72 57.72 58.14 0.15 58.23 494837.0 185715.0

2020-01-15 58.2 58.36 57.36 58.1 0.42 57.81 426110.0 136771.0

2020-01-16 58.1 58.87 57.56 58.59 0.71 58.52 178898.0 96523.0

2020-01-17 58.59 58.98 58.27 58.81 0.02 58.54 118984.0 73735.0

2020-01-21 59.17 59.73 57.68 58.25 0.2 58.34 36251.0 31495.0

Collapsing/Aggregating

# Get the last values observed at the end of each month

eom(crude)71x8 TS{Float64,Dates.Date}: 2014-02-28 to 2019-12-31

Index Open High Low Last Change Settle Volume Previous Day Open Interest

2014-02-28 102.15 102.96 101.8 102.55 0.19 102.59 163899.0 307986.0

2014-03-31 101.69 101.97 100.88 101.58 0.09 101.58 154973.0 334474.0

2014-04-30 100.76 100.76 99.35 99.74 1.54 99.74 294775.0 341594.0

2014-05-30 103.51 103.56 102.4 102.7 0.87 102.71 185506.0 303623.0

2014-06-30 105.69 105.76 104.66 105.37 0.37 105.37 229049.0 293795.0

2014-07-31 99.47 99.85 97.6 98.15 2.1 98.17 335785.0 308055.0

2014-08-29 94.56 96.0 94.48 95.96 1.41 95.96 234972.0 280113.0

⋮

2019-05-31 56.46 56.61 53.05 53.36 3.09 53.5 1.019958e6 376374.0

2019-06-28 59.22 59.8 57.75 58.2 0.96 58.47 546625.0 334543.0

2019-07-31 58.34 58.82 57.81 57.89 0.53 58.58 604858.0 406009.0

2019-08-30 56.63 56.72 54.55 55.16 1.61 55.1 698554.0 373402.0

2019-09-30 56.54 56.57 53.98 54.24 1.84 54.07 520489.0 380790.0

2019-10-31 54.9 55.59 53.71 54.14 0.88 54.18 664901.0 411933.0

2019-11-29 58.13 58.3 55.02 55.42 2.94 55.17 716575.0 456055.0

2019-12-31 61.68 61.88 60.63 61.21 0.62 61.06 490241.0 411296.0

# (NOTE: the `eom` function returns a Boolean Vector when passed a Vector of TimeTypes)

[crude.index eom(crude.index)]1488×2 Array{Any,2}:

2014-02-18 false

2014-02-19 false

2014-02-20 false

2014-02-21 false

2014-02-24 false

2014-02-25 false

2014-02-26 false

2014-02-27 false

2014-02-28 true

2014-03-03 false

⋮

2020-01-08 false

2020-01-09 false

2020-01-10 false

2020-01-13 false

2020-01-14 false

2020-01-15 false

2020-01-16 false

2020-01-17 false

2020-01-21 false# monthly averages for all columns

collapse(crude, eom(crude.index), fun=mean)71x8 TS{Float64,Dates.Date}: 2014-02-28 to 2019-12-31

Index Open High Low Last Change Settle Volume Previous Day Open Interest

2014-02-28 102.3989 103.1889 101.6878 102.5711 0.7444 102.5656 148776.5556 225805.7778

2014-03-31 100.5271 101.34 99.649 100.5243 0.959 100.509 206373.7143 231903.8095

2014-04-30 102.0333 102.7633 101.3405 102.0281 0.7486 102.0348 233282.8095 257696.381

2014-05-30 101.7 102.3552 101.2162 101.8033 0.6467 101.7948 217432.9524 250507.7143

2014-06-30 105.0576 105.7629 104.4638 105.1448 0.4662 105.1467 206555.9048 224720.4286

2014-07-31 102.5386 103.1968 101.5936 102.3782 0.795 102.3918 240224.6818 227645.2273

2014-08-29 95.9971 96.7362 95.3 96.1643 0.7681 96.0762 228620.4286 218962.7143

⋮

2019-05-31 61.2995 61.9764 60.0618 60.8673 0.8941 60.8655 729461.9091 317816.3636

2019-06-28 54.53 55.5395 53.716 54.7415 0.8935 54.7065 615311.3 265630.05

2019-07-31 57.6964 58.5318 56.8555 57.5859 0.8114 57.5464 531061.1364 272989.6364

2019-08-30 55.0186 55.9482 53.8891 54.93 1.2995 54.8441 629838.3182 299615.3182

2019-09-30 57.4045 58.144 55.977 56.957 1.3045 56.967 644389.25 280172.25

2019-10-31 54.0148 54.7313 53.147 54.0109 0.5848 54.0057 493907.6522 300861.9565

2019-11-29 57.034 57.813 56.217 57.0905 0.8775 57.07 463655.9 324869.85

2019-12-31 59.5745 60.2685 59.1545 59.848 0.5035 59.8735 422463.45 325668.5

# Get the total yearly trading volume of crude oil

collapse(crude[:Volume], eoy(crude.index), fun=sum)6x1 TS{Float64,Dates.Date}: 2014-12-31 to 2019-12-31

Index Volume

2014-12-31 5.5485488e7

2015-12-31 9.1545306e7

2016-12-30 1.3244229e8

2017-12-29 1.4530684e8

2018-12-31 1.46933685e8

2019-12-31 1.45134633e8

Visualization

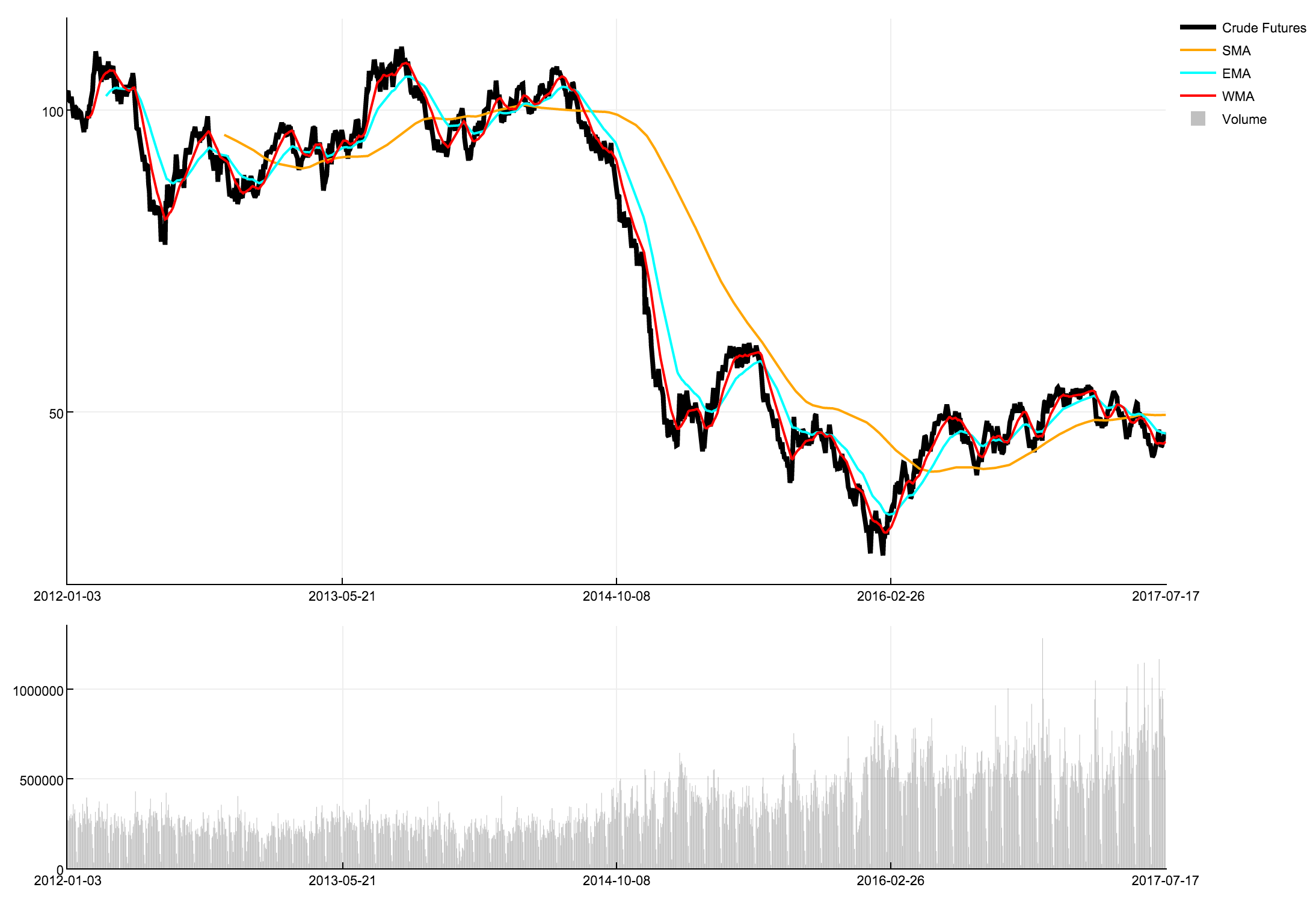

Visualization capabilities are made available by the plotting API's made available by the impressively thorough and all-encompassing Plots.jl package. Temporal uses the RecipesBase package to enable use of the whole suite of Plots.jl functionality while still permitting Temporal to precompile. The package Indicators package is used to compute the moving averages seen below.

# download historical prices for crude oil futures and subset

X = quandl("CHRIS/CME_CL1")

subset = "2012/"

x = cl(X)[subset]

x.fields[1] = :CrudeFutures

# merge with some technical indicators

D = [x sma(x,n=200) ema(x,n=50)]

# visualize the multivariate time series object

plotlyjs()

ℓ = @layout [ a{0.7h}; b{0.3h} ]

plot(D, c=[:black :orange :cyan], w=[4 2 2], layout=ℓ, subplot=1)

plot!(wma(x,n=25), c=:red, w=2, subplot=1)

bar!(X["2012/",:Volume], c=:grey, alpha=0.5, layout=ℓ, subplot=2)

Miscellany

Acknowledgements

This package is inspired mostly by R's xts package and Python's pandas package. Both packages expedite the often tedious process of acquiring & munging data and provide impressively well-developed and feature-rick toolkits for analysis.

Many thanks also to the developers/contributors to the current Julia TimeSeries, whose code I have referred to countless times as a resource while developing this package.

Temporal vs. TimeSeries

The existing Julia type for representing time series objects is a reasonably reliable and robust solution. However, the motivation for developing Temporal and its flagship TS type was driven by a small number of design decisions and semantics used in TimeSeries that could arguably/subjectively prove inconvenient. A few that stood out as sufficient motivation for a new package are given below.

- A key difference is that Temporal's

TStype is defined to bemutable, whereas the TimeSeriesTimeArraytype is defined to beimmutable- Since in Julia, an object of

immutabletype "is passed around (both in assignment statements and in function calls) by copying, whereas a mutable type is passed around by reference" (see here), theTStype can be a more memory-efficient option- This assumes that proper care is taken to modify the object only when desired, a consideration inseparable from pass-by-reference semantics

- Additionally, making the

TSobjectmutableshould provide greater ease & adaptability when modifying the object's fields

- Since in Julia, an object of

- Its indexing functionality operates differently than expected for the

Arraytype, such that theTimeArraycannot be indexed in the same manner- For example, indexing columns must be done with

Strings, requiringArray-like indexing syntax to be done on the underlyingvaluesmember of the object - Additionally, this difference in indexing syntax could cause confusion for newcomers and create unnecessary headaches in basic data munging and indexing tasks

- The syntax is similar to that of the

DataFrameclass in Python. While this a familiar framework, R'sxtsclass is functionally equivalent to the matrix clas - In like fashion, a goal of this package is for the

TStype to behave like anArrayas much as possible, but offer more flexibility when joining/merging through the use of *temporal- indexing, to simplify challenges uniquely associated with managing time series data structures

- For example, indexing columns must be done with

- Another difference between

TSandTimeSerieslies in the existence of a "metadata" holder for the object- While this feature may be useful in some cases, the

TSobject will likely occupy less memory than an equivalentTimeSeriesobject, simply because it does not hold any metadata about the object - In cases where such underlying metadata is of use, there are likely ways to access it without attaching it to the object

- While this feature may be useful in some cases, the

- A deliberate stylistic decision was made in giving Temporal's time series type a compact name

- While the

TimeSeriespackage names its typeTimeArray, typing out nine characters can slow one down when prototyping in the REPL - Creating a type alias is certainly a perfectly acceptable workaround, but only having to type

TS(orts) when constructing the type can save a considerable amount of time if you're experimenting in the REPL for any length of time - Additionally, if you don't want to type out field names every time you instantiate a new time series, the

TSclass will auto-populate field names for you

- While the

So in all, the differences between the two classes are relatively stylistic, but over time will hopefully increase efficiency both when writing and running code.